Ryan Reynolds leading a consortium that invested heavily in Alpine’s F1 future took the entire world by storm. The Enstone-based outfit was in dire need of some huge cash injection, and Reynolds and Co. ended up investing $218,000,000. Out of that, it was Reynolds who took $15,000,000 out of his own account to make a hefty contribution to this deal. However, according to Business F1 Alpine was forced to take the money to repay a loan to Renault.

The Alpine name made its debut in F1 back in 2021, after Renault’s departure from the sport. Alpine is the French company’s sports car division, and although their names and the people running them differ, they work closely. However, the relationship between Alpine’s F1 team and the Renault group soured when the latter forced them to repay a loan, even though they were facing difficulties themselves.

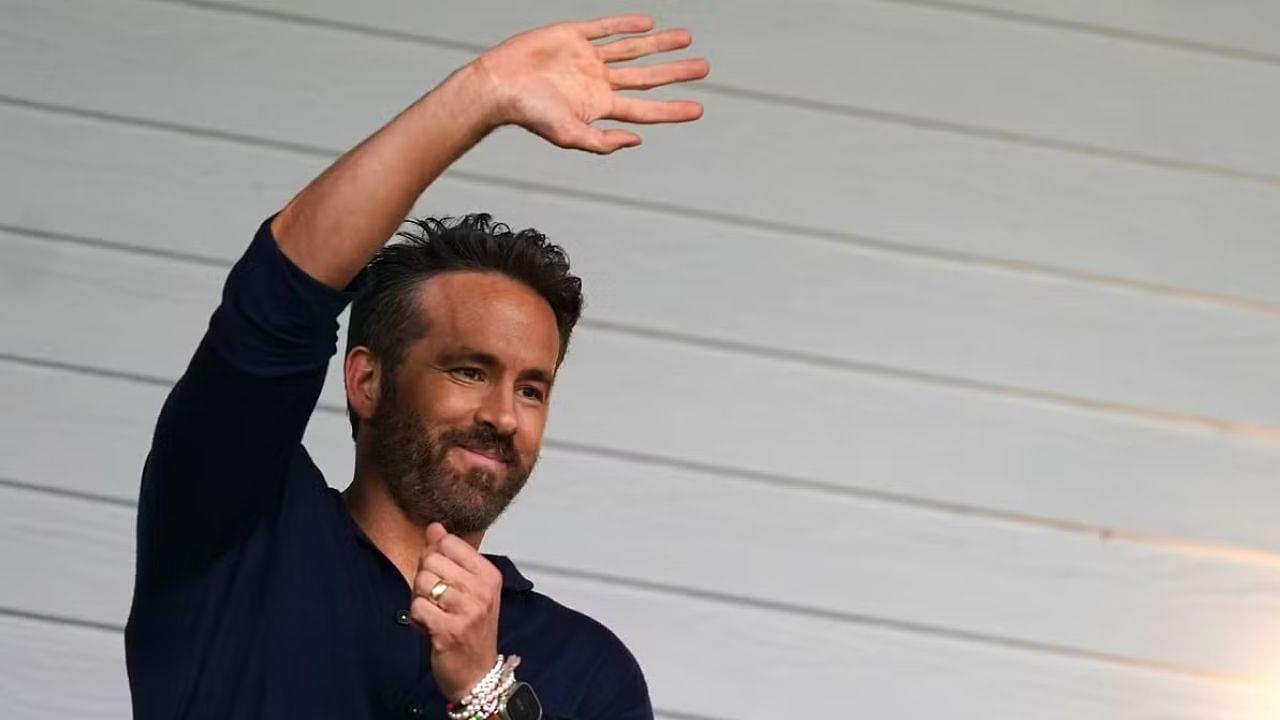

BREAKING: Hollywood actor Ryan Reynolds is part of an investor group taking a 24% equity stake in Alpine #F1 pic.twitter.com/0K2867UBOg

— Formula 1 (@F1) June 26, 2023

Alpine’s F1 team took a loan of $200,000,000 from Renault, which they were struggling to clear. After a lot of pressure from the heads of Renault Group, Alpine accepted Reynolds’ consortium’s deal, to sell its shares and clear its dues.

Why Alpine was forced to do business with Ryan Reynolds

Financially, it seemed as though Alpine was doing just fine from the outside, but internally, the bosses were concerned about the team nearing insolvency. In 2021, they had a turnover of $250,000,000, which helped them make profits of about $37,000,000. However, this figure wasn’t enough to get them out of trouble.

Its auditors, KPMG, were forcing Alpine to ‘inject new capital’, to clear a deficit of $35,000,000. Their being short of this amount, nearly drove them toward insolvency. As a result, it wasn’t just Renault who was forcing Alpine to clear the loan dues, but KPMG too began putting pressure on the Formula 1 team from Enstone.

As a result, when Reynolds and the other investors came knocking, Alpine was forced to sell the team’s shares for $218,000,000. This allowed them to pay whatever amount they owed to Renault, and more importantly, save themselves from insolvency.

How Alpine’s new cash injection makes them a near-billion-dollar F1 team

Alpine had deep pockets already because of its ties to Renault, but they still lacked in terms of resources to the likes of Mercedes, Ferrari, and Red Bull. However, the team sold 24% of its shares to Reynolds and other buyers, which increased its value drastically. Previously, they were valued at close to $900,000,000 which increased as soon as the takeover was complete.

Today, Renault Group and Alpine announce the sale of a 24% stake in Alpine Racing Ltd to a strategic investor group.

Read more 👇

— BWT Alpine F1 Team (@AlpineF1Team) June 26, 2023

Alpine’s decision to have this deal go through also points towards their interest in increasing market presence in the United States of America. F1 is growing rapidly in the US, and they could use a lot of help in bolstering their marketing activities there with the money that this new deal brings to the table.

Admittedly, Alpine’s boss Laurent Rossi, himself said that the money that Reynolds and Co. will bring in will solely be used for commercial purposes. The sporting side of things will be taken care of, as it has been over the last two years.