When Caleb Williams signed his four-year, $39 million rookie deal with a $25 million signing bonus, his focus wasn’t just on enjoying his newfound riches. The Bears QB also showed a sharp eye for multiplying his wealth.

Advertisement

Shortly after signing, the USC alum launched his own investment firm, 888 Midas, alongside trusted advisors like Lew Wolff and Ross Walker. He also diversified his portfolio by stepping into real estate, with reports confirming he bought a $12.9 million mansion in Illinois overlooking Lake Michigan.

Williams‘ financial awareness made headlines again when it came out that he wanted his NFL salary paid through an LLC [Limited Liability Company]. The idea was simple: as financial advisor and entrepreneur Karlton Dennis explained, Williams wanted the same kind of control over his income that business owners have.

“Caleb wanted to get paid through his LLC because he wanted to reduce his taxes, and he approached it from the sense of, ‘if I’m an entertainer, that means I’m a 1099 contractor… I should be able to dictate how I spend my money before I pay Uncle Sam,’” Dennis said on No Free Lunch Show.

He added, “When you’re a business owner, you get paid first, you spend money second, and then Uncle Sam gets paid third. But when you’re a W-2 [employee], you make money, Uncle Sam gets paid, and then you’re spending what’s left over. He was trying to flip the table.”

In theory, it was “absolutely genius,” Dennis said, but there was one problem: NFL contracts are structured with players as employees, meaning paychecks must run through the league’s W-2 system. So unsurprisingly, Williams’ request was denied.

View this post on Instagram

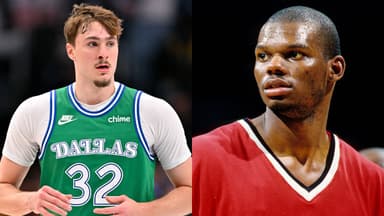

That said, the Bears star isn’t the first player to push for this. Arizona Cardinals legend and 6x Pro Bowler Calais Campbell revealed in the comments of the video that he once tried the same approach during his playing days.

“I tried the same thing. It was worth the effort but didn’t work out,” Campbell admitted, showing that even established veterans were interested in the potential tax benefits but ran into the same dead end.

This Cardinal also wanted pay through LLC but nfl teams would never agree

https://t.co/gcYpKcfxJs pic.twitter.com/PH26XrE3Tp

— NFL World, What’s Up?? (@Whats_Up_NFL) August 20, 2025

The catch, however, is that not everyone sees this as a clever workaround.

When news about Williams’ LLC interest first broke, Financial literacy entrepreneur John Hope Bryant had warned that whoever advised Caleb on the plan gave him “very bad advice,” stressing that it could have gotten him in legal trouble.

“That person could have gotten Caleb in prison,” Bryant bluntly said, noting that “avoiding federal taxes” is a “felony”.

All told, while the LLC move never went through, it sheds light on a bigger truth: NFL players today are thinking harder about their money than ever before.