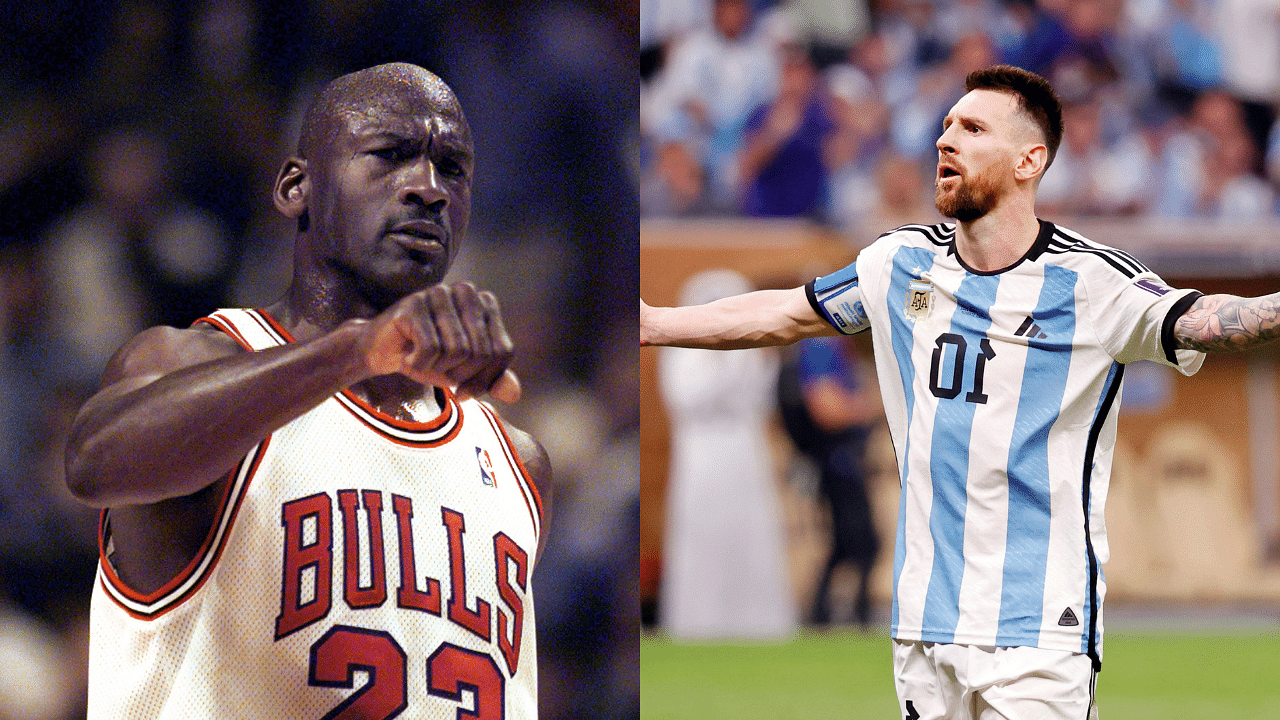

Lionel Messi, the Barcelona legend, has joined the ranks of footballers making a move to the United States, following in the footsteps of Zlatan Ibrahimovic, David Beckham, and others. His lucrative four-year contract, estimated at $216,000,000 according to Forbes, is set to be impacted by the “jock tax” in the US, a tax that gained fame after the enactment of the “Michael Jordan’s revenge” law by Illinois in 1991, following the Bulls’ victory over the LA Lakers in the NBA Finals.

Advertisement

After the Bulls beat the LA Lakers, California assessed the income taxes owed by the Bulls’ players. This led Illinois to decide to tax athletes from other states on their earnings in the state. Other states soon followed suit. Famous athletes have little option but to pay the tax due to the public nature of their earnings.

Lionel Messi might end up paying millions of his overall earnings in income tax

The jock tax, a luxury threshold tax imposed on athletes who earn income outside their home states, is set to impact Lionel Messi in 2023. This tax, made popular by Michael Jordan in 1991, requires notable athletes to pay a portion of their earnings in income tax due to the public nature of their income. As a result, Lionel Messi may find himself paying a significant portion of his overall earnings in income tax.

Given Messi’s annual income of over $60 million from wages alone, and considering that he will play a significant number of games outside of his home state of Florida with Inter Miami, his jock tax liability is expected to be substantial. It’s important to note that only a handful of states, including Florida, Nevada, Texas, Washington, and Tennessee, currently do not impose the jock tax.

Florida’s zero income tax will be a huge relief for Inter Miami’s Messi

Despite the jock tax, Messi will benefit from Florida’s zero income tax policy, offering him considerable relief. While the jock tax alone is projected to surpass the $2 million threshold, Messi’s tax savings in Florida will outweigh this amount, as he will no longer be liable for income tax. In comparison, during his time in Paris, Messi was subject to a 30% tax rate on his earnings.

https://twitter.com/AlbicelesteTalk/status/1666496379424759892

The $216 million four-year contract represents a substantial increase in the overall income of the six-time Ballon d’Or winner. It is widely regarded as one of the most significant signings in US sports history. Inter Miami stands to gain from Messi’s on-field contributions. Additionally, also from the immense interest and jersey sales generated by the footballing icon.