Michael Jordan made a lot of people mad back in the day because of how dominant he was. He even managed to anger the entire state of California.

Advertisement

The Bulls legend has accomplished what NBA players dream of doing in his career. Six championships, six Finals MVP’s, five NBA MVP’s, an obvious Hall of Fame induction, and much more has cemented Jordan’s legacy as the greatest NBA player of all time.

So, why was his career so confusing? Well, he retired thrice in his career, to give you some context. If that sounds weird to you, that’s because it is. His first retirement was by far the most surprising as it came only nine years into his career, and he had just started to win at the highest level, coming off of his first threepeat.

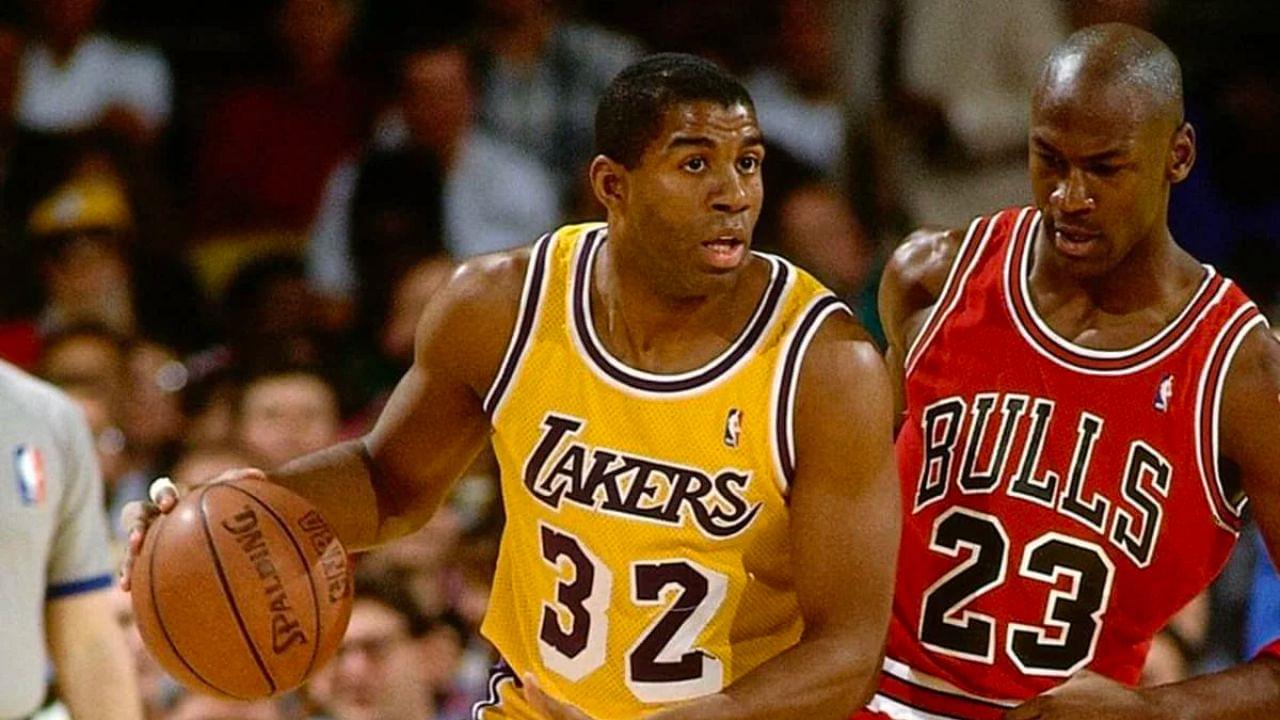

His first championship came against Magic Johnson and the Los Angeles Lakers. In the 1980s, there was no team more dominant than LA. Pairing Kareem Abdul-Jabbar and Magic brought the city five titles in the decade. However, after Kareem’s retirement, Magic couldn’t keep the show going on his own.

🏆

31 years ago today: our first NBA title. pic.twitter.com/BnS62qehCr

— Chicago Bulls (@chicagobulls) June 12, 2022

California got revenge on Michael Jordan for downing Magic Johnson

Jordan and the Bulls beating Magic in the Finals was a little shocking, even if Magic was a little past his prime. Chicago was celebrating their first title, and Jordan was thrilled to have finally made it over the hump.

However, the state of California had other plans. After the Finals were over, perhaps in attempt to get back at MJ for downing their home-state hero, California notified Jordan that he was due to pay taxes in the state for the time he spent there during the Finals.

This became known as the ‘jock tax.’ The jock tax still applies in many states today, and the rates are different depending on which state you’re in. California has the highest jock tax rate at 13.3%.

Illinois tried to get back at California by imposing their own tax on athletes from the state, but it wasn’t the same as it only applied to Californian athletes. Jordan’s salary in 1991 was $2.5 million, but because of the jock tax, he wasn’t able to receive all of it.

Jock tax is calculated by finding your income earned in a particular state and then applying the rate to it. The state income is calculated by multiplying your yearly salary with the number of dudty days in the state divided by your total duty days.

The jock tax has made it very hard for athletes to file taxes as they need to fill out multiple return forms for different states. California did it to get back at Jordan, but now, it’s a very real thing in sports.

Happy 58th birthday to Michael Jordan, 6x champion, global icon, and originator of the jock tax—the levy athletes pay on salary earned for away games. #TalkingTax pic.twitter.com/erFXyPX7Ou

— Sam McQuillan (@sam_mcquill) February 17, 2021