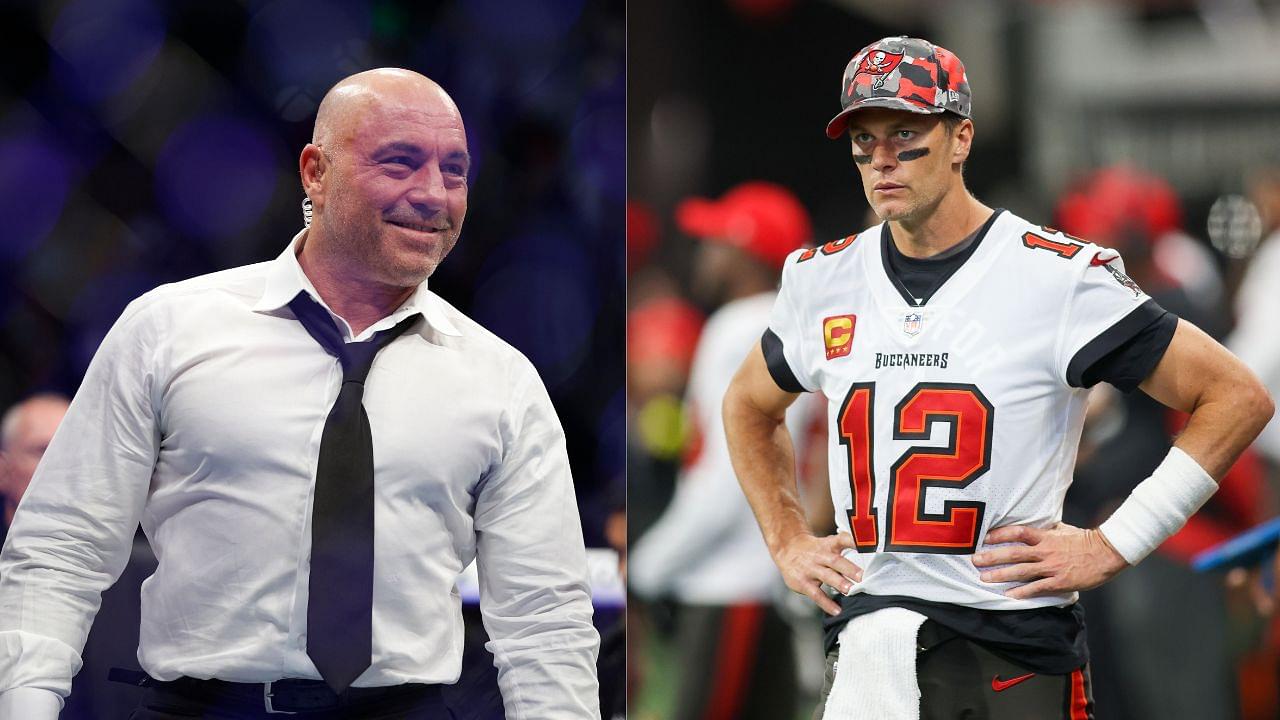

Tom Brady-backed FTX sent shockwaves across the internet when the crypto exchange filed for bankruptcy last year. A massive hole of $8 billion was found in the account books, with investors rushing to recoup their money. Recently, the popular podcaster Joe Rogan and crypto journalist Coffeezilla analyzed the entire situation and blamed social marketing as one of the major reasons behind this debacle.

Advertisement

This crypto crash witnessed one of the biggest free falls in the history of the investment business. Despite receiving endorsements from prominent personalities, the company failed to sustain its position. Currently, its former CEO, Sam Bankman-Fried is under close scrutiny by SEC and faces charges of financial misconduct.

Was this an orchestrated scandal?

Well, it’s quite difficult to judge at this point but looking at how things are moving forward, the entire incident delivers a valuable lesson. Unless there is no solid proof or an investor trusts the source, there is no point in following such misleading advertisements.

Apparently, the NFL legend Tom Brady, NBA Superstar Steph Curry, Shaquille O’Neal along with many others were part of this marketing campaign.

According to Coffeezilla, there is something called social impact. “The threat is you believe, you know, it’s kind of too good to be true. but the social proof is overwhelming. And it overwhelms, you’re kind of like alarm bells,” he said on the Joe Rogan podcast.

The analyst gave an apt example saying that if a person drives a Toyota, no one would believe him getting involved in a scam. It applies to Tom Brady as well, who has been vocal about the crypto business. People who follow him blindly consider his words as a seal of trust. As a result, they invested a major chunk of their wealth until it got wiped off in November of 2022.

How much did Tom Brady lose from his investment?

Ever since the FTX boom started captivating people, Brady joined hands with Bankman-Fried as one of his primary endorsers. In no time, the market saw an unprecedented surge touching the incredible $3 trillion mark. Just like other big names from the industry, the former NFL quarterback purchased 1.1 million common shares. Its highest values were estimated at around $93 million.

Meanwhile, his ex-wife Gisele Bündchen had also invested in FTX, buying as much as 680,000 shares. However, the twist of fate had something else planned, and everything changed overnight. According to Radaronline.com, the power couple lost 1.7 million shares. While the investigation continues to progress, readers can stay tuned for regular updates on this issue.