No other state like California fits that famous quote we read once in a while: “Nothing is certain except death and taxes.” But the question is, is it so bad that an NFL athlete like Justin Herbert, who has a $52.5 million AAV in his NFL contract with the Chargers, takes home less than half?

Advertisement

Before we delve into it, it should be clear that an NFL player, unlike rookies on fixed-scale deals, does not always receive the full stated value of a long-term contract. While signing bonuses and certain guarantees are paid, base salaries and incentives are not always fully guaranteed and can affect the total earnings. Still, for clarity, we’ll calculate the full AAV.

Claim: Justin Herbert takes home a measly $24.22 million payout after California taxes his $52.5 million per year contract.

Source of the Claim: NFL aggregator MLFootball shared this interesting tidbit on X (formerly Twitter), and we have to say that this page has shared this news many times in the past. Perhaps because of how absurd the pay cut sounds, even for a millionaire athlete like Herbert.

AWFUL#CHARGERS QB JUSTIN HERBERT ONLY MAKES 24 MILLION DOLLARS AFTER TAXES, DESPITE SIGNING A 60 MILLION DOLLAR DEAL.

Federal: $19.4M

FICA: $1.24M

California State: $6.9M

SDI Tax: $630K

Jock: $220K

Total Tax: $28,287,427Approximate Net Income: $24M

This is brutal pic.twitter.com/eMxGNZXTZl

— MLFootball (@MLFootball) February 11, 2026

Verdict: True. While MLFootball botched Herbert’s annual value and wrote it as $60 million, the fact that the QB loses a whole lot of money and takes home less than half is factual.

Out of his $52.5 million, approximately $19.45 million is cut for federal taxes, $6.96 million for California state income tax, and $2.1 million for FICA, which brings the total cut to $28.28 million. That leaves Herbert with $24.22 million per year in take-home money. Insane!

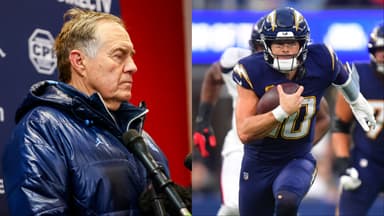

But Herbert isn’t alone in this, as another LA QB we know, Matthew Stafford, takes home just $19.7 million from his $44 million per year contract with the Rams. He pays $16.2 million in federal taxes, $5.85 million in state tax, approximately $1.32 million in agent fees, and $665,000 for FICA.

From the Bay Area, Brock Purdy, who secured a $53 million per year contract with the 49ers, takes home $24.6 million. He pays $19.57 million in federal taxes, $7.53 million in California state tax, and $1.25 million in FICA taxes.

But how is it for quarterbacks in states that have no state income tax? Well, Dak Prescott of the Dallas Cowboys takes home $39.9 million per year, close to $40 million, out of his $60 million per year contract after other taxes and no Texas taxes.

Let’s also talk about jock taxes for visiting players in California. It turns out that playing Super Bowl LX in the state left some players with less, much less, after-tax income than if the game had been played in another state.

In fact, Seahawks QB Sam Darnold, who triggered a $178,000 incentive for his appearance in the Super Bowl, saw his estimated state tax bill reach a whopping $249,000, resulting in a net loss of roughly $71,000. If it weren’t for his $1 million bonus for a Super Bowl win, we’d almost feel sorry for Darnold on this one.