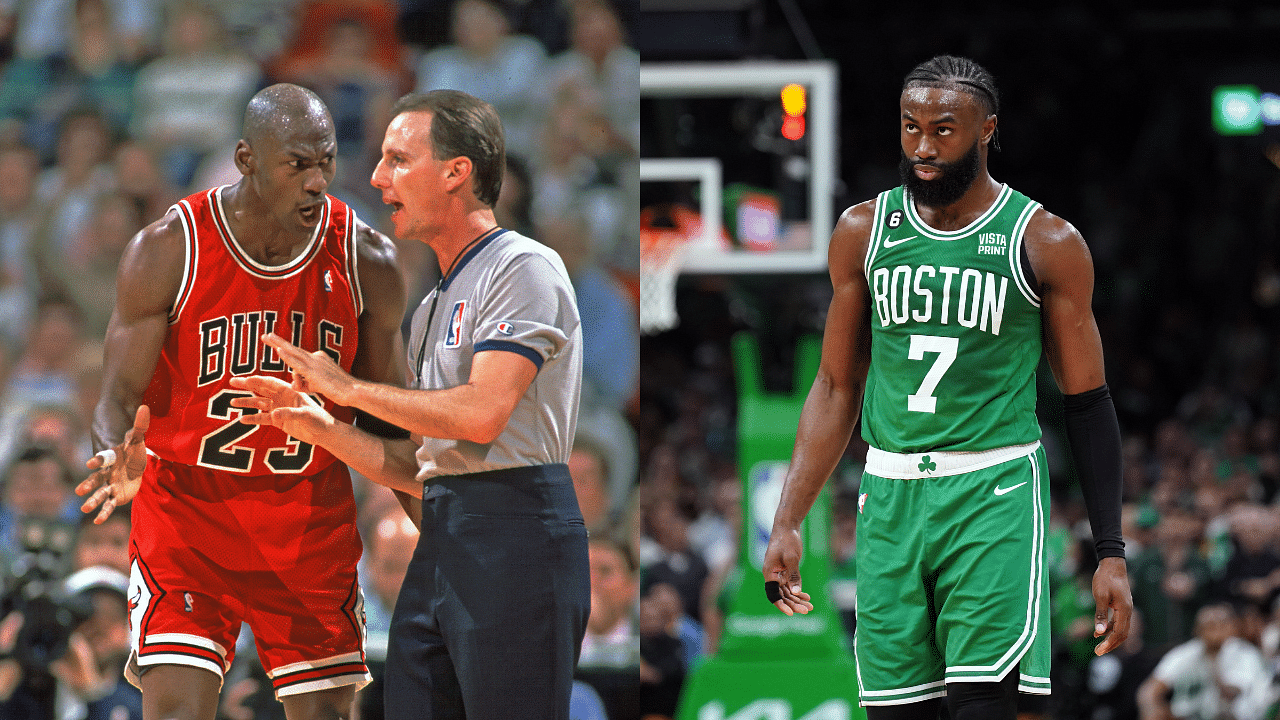

The Boston Celtics have made history by signing Jaylen Brown to a record-breaking five-year $304,000,000 supermax extension contract, which is the richest deal in NBA history. The contract is fully guaranteed and includes a trade kicker but lacks a player option in its final year. By 2026, Brown will earn an annual salary of $60,800,000, but after various taxes and deductions, his net income will be reduced to $24,500,000. One notable deduction is the $1,800,000 in jock taxes, first introduced because of Michael Jordan. Andrew Petcash on Twitter provided a detailed breakdown of these deductions on Brown’s paycheck.

Advertisement

Taxes and deductions, particularly jock taxes, significantly impact a player’s income from their contract. It’s surprising that Jaylen Brown’s massive $36,300,000 deduction comes despite his NBA record-breaking deal.

Jaylen Brown will face around $36.3 million in cuts from his massive 2026 paycheck

Brown committed to the Boston Celtics for five more years, securing a $304 million contract. By the 2026-27 season, he will earn $60,746,979 annually. However, various hurdles could reduce his net income to just $24.5 million.

Andrew Petcash on Twitter analyzed the deductions, which add up to Jaylen’s $36.3 million hit. Out of his $60,746,979 salary, $22.5 million will be deducted for Federal Tax. Additionally, he faces payments of $6 million for NBA Escrow, $1.8 million for Agent Fee, $1.4 million for FICA/Medicare, $1.8 million in jock taxes, and $2.7 million in Massachusetts state tax.

His net income is now only $24.5 million after various deductions, with the jock tax accounting for a significant portion. The jock tax took its modern form following the 1991 NBA Finals between the Los Angeles Lakers and Chicago Bulls. It was imposed on all Bulls players, coaches, and staff who traveled to Los Angeles. In response, Illinois enacted its own jock tax, commonly referred to as Michael Jordan’s revenge.

Currently, jock taxes are implemented in over 21 states and eight municipalities. California leads in jock tax collection, with a rate of 13%. In 2013, the state collected $229.2 million in tax revenues from this measure.

Jaylen Brown’s new contract is a massive upgrade for his salary from his previous contract

In 2020, Jalen Brown signed a four-year contract worth $106,333,334, guaranteeing him $103,000,000 as a base salary of $26,583,334. In the 2023-24 season, his base salary will be $28,508,929 with a cap hit of $31,830,357.

With his new $304 million contract, Jalen Brown’s earnings will surpass his previous deals. Taking into account off-court earnings, he might soon become one of the wealthiest NBA athletes.